First Step Management has been in the real estate business in North Texas since 2002, and we have seen all kinds of programs offered by our competitors that just didn’t work. For this reason we have tailored our Steps to Home Ownership Program around what does work; accepting wherever our clients are starting and guiding them down the right path.

First Step Management has been in the real estate business in North Texas since 2002, and we have seen all kinds of programs offered by our competitors that just didn’t work. For this reason we have tailored our Steps to Home Ownership Program around what does work; accepting wherever our clients are starting and guiding them down the right path.

Most programs that appear to be similar to this lack the

flexibility, customer orientation, and personalized service that we offer.

The Steps to Home Ownership Program was created because 80% of Americans cannot qualify for a traditional loan from a bank or mortgage company in todays market; resulting in the lowest ownership rate in 70 years. The program was designed to provide the greatest chance for successful home ownership by eliminating the common hidden disqualifiers you find in almost all other programs. You may know someone who has been victim of fraudulent or deceptive real estate practices. Or possibly even been a victim yourself; paying the landlord without fail to only to find the mortgage company has foreclosed on that house and you now have to move. This is something different.

The Steps to Home Ownership Program was created because 80% of Americans cannot qualify for a traditional loan from a bank or mortgage company in todays market; resulting in the lowest ownership rate in 70 years. The program was designed to provide the greatest chance for successful home ownership by eliminating the common hidden disqualifiers you find in almost all other programs. You may know someone who has been victim of fraudulent or deceptive real estate practices. Or possibly even been a victim yourself; paying the landlord without fail to only to find the mortgage company has foreclosed on that house and you now have to move. This is something different.

Welcome to your personal Steps to Home Ownership!

To show the some of the greatest benefits of this program, lets first highlight what you DON’T want and the reasons why

TRAP #1: If you miss a deadline or a payment, then you forfeit all down payment moneys.

-

- This is part of almost every other program out there and only favors the company because any “bump in the road” causes you to lose your investment.

TRAP #2: The monthly payment is not an accurate reflection of the house value.

-

- This is most commonly seen from an individual who is fearful of charging the proper amount because they don’t want to see the house vacant. So they drop the price below the mortgage payment amount to fill the house fast. But now they struggle making the mortgage payment every month.

- Too low is actually more dangerous than too high of a payment, but neither is good.

TRAP #3: There are restrictions that prevent refinancing.

-

- Many programs lock you into ridged time restraints. Any deviation is considered breach of contract, even if it is a positive action.

- And any “breach” causes you to loose your entire investment (see Trap #1)

TRAP #4: Long qualification periods

-

- Many similar programs require 12 month or even 24 month qualification periods.

TRAP #5: Adjustable interest rates

-

- Companies who offer these don’t really want to ever see the customer own anything. They know they will eventually push you out of the house as the loan payment goes up and up – then they can do it all over again to someone else.

TRAP #6: Balloon loans; meaning the entire balance will be due at one-time before the full term of the loan.

-

- Similar to adjustable rate loans, a balloon payment requires the customer to have all the cash or refinance before that date – which often doesn’t happen. When that doesn’t happen you are in default and have to move out of the house losing all of your investment.

TRAP #7: Prepayment or early-payment penalties

-

- In our opinion this is one of the worst ones because it penalizes the person who is succeeding. This imposes an additional fee if and when you are ready to pay-off or refinance the house.

None of the above traps help the client achieve their dreams of owning a home; they all only benefit the company offering the program. While it is legal to do these things, we don’t believe strategies like this are necessary. The Steps to Home Ownership is designed to avoid the common traps of so many other programs, to be realistic for the world we live in, and flexible enough to be able to make adjustments if mistakes happen.

Below are some of the things that allow us to say there is no other program like ours

We were the first to become certified as an Affordable Housing Provider, in the Dallas/Fort Worth area. This makes us part of a national network of people and companies who offer affordable housing within the communities they live/operate.

We were the first to become certified as an Affordable Housing Provider, in the Dallas/Fort Worth area. This makes us part of a national network of people and companies who offer affordable housing within the communities they live/operate.- The terms and conditions of our agreements are written in preparation of an unexpected event happening.

-

- This provides for exceptions and protection if something happens you didn’t plan on and protects you from losing your investment.

-

- The monthly payment is a reflection of the fair market value of the house.

- Our program only has a 6 month qualification period.

-

- We don’t know of a program or company offering a shorter qualification period than ours.

-

- There are no restrictions, penalties, or hidden fees for prepayment or refinancing.

-

- Whether it is 1 month, 1 year, or 10 years – there is no penalty to pay-off or refinance your home.

-

- None of our products have adjustable rates.

-

- This protects you from your payment increasing to a level you can no longer afford.

-

- We do not offer balloon loan products.

- We do not require bank financing or bank qualifying.

- We do not require a minimum credit score. We don’t even check your credit score!

- The Phase 2 of our program allows you to take advantage of income tax deductions.

- We offer extremely flexible down payment requirements.

-

- This allows you to get off the “rental wheel” and get started with home ownership sooner.

-

So how does it work?

So how does it work?

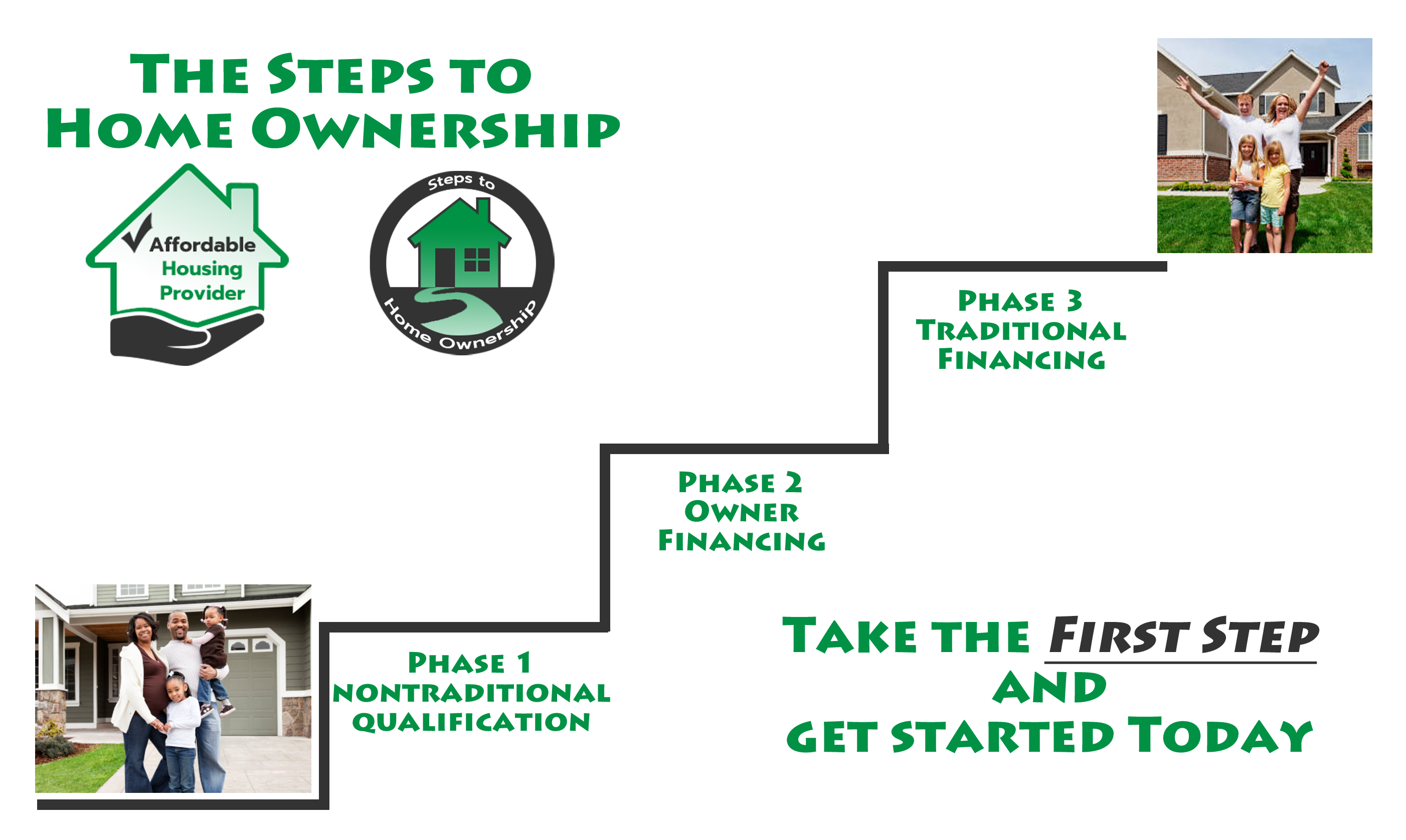

The program is divided into two main phases and has a 3rd optional phase

-

- Phase 1 is the Qualification Phase and must be completed first.

-

- Phase 1 Fast Track: If you have 10% as a down payment in cash (Work for Equity does not count), then Phase 1 can be shortened.

-

- Phase 2 is the Owner Financing Phase

- OPTIONAL Phase 3 is to Go Beyond Owner Financing

- Phase 1 is the Qualification Phase and must be completed first.

Since we do not require any traditional credit qualification, we do require completion of Phase 1 – Qualification. In this phase you prove your ability to be a home owner and make your payments on-time. After Phase 1 is complete, then you are qualified for Phase 2 – Financing. Even after you enter into the financing phase of the program, the flexibility doesn’t change. The optional Phase 3 has been made part of the program to encourage clients to do what is best for them. That if they can get a better interest rate somewhere else; to do it, and you won’t be penalized for it.

For more information of either of the individual phases click on the corresponding link or Contact Us for more information.

Ready to get started? Then Submit Your Information and take the First Step in becoming a client and achieving your dreams.

Ready to get started? Then Submit Your Information and take the First Step in becoming a client and achieving your dreams.